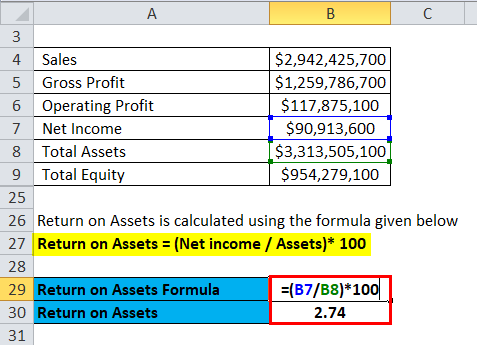

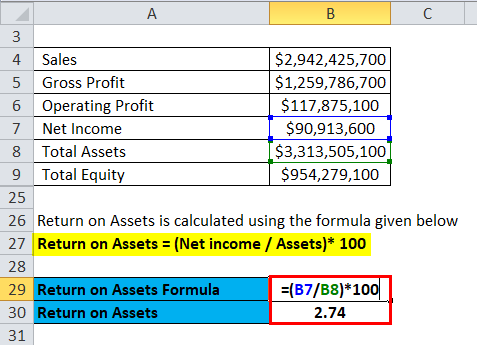

Drive sales with a free plan that never expires. ROI is expressed as a percentage and is commonly used in making financial decisions, comparing companies profitability, and comparing the efficiency of different investments. According to the website Principles of Accounting, both forms of recording profits typically are utilized to monitor company growth. Emily Guy Birken is a former educator, lifelong money nerd, and a Plutus Award-winning freelance writer who specializes in the scientific research behind irrational money behaviors. ". Mathematically, the calculation for cap rate is Net Operating Income (NOI) divided by the purchase price or market value: For example, if a property generates $1 million in Net Operating Income (NOI = total income minus operating expenses) in year 1 and the purchase price was $15 million, the resulting cap rate of 7% represents the year one annual return. This loss is very difficult to measure because customers simply come and go without making a purchase, and often without requesting to be put on a waitlist for notification when the size becomes available. "Our sales revenue has grown by 18% since we started using Snov.io", "With Snov.io we discovered new ways of lead generation. Although the two are often considered synonymous, there is a difference. A propertys capitalization rate is an estimate of the annual return in an all cash purchase. real estate investor, whether they focus on commercial or residential property. While the cap rate calculation itself may be simple, the logic behind it is anything but.  To calculate the operating margin, divide operating income (earnings) by sales (revenues). Expressed as a ratio, ROS can tell two important things about your overall revenue: To put it short: ROS shows how much profit is generated per dollar of revenue. It shows a relationship between how your managers use labor and cost of goods to produce saleable inventory. tax due is not equal to the tax withheld) resulting to collectible or refundable return Please try again later. The formula for calculating the return on sales ratio consists of dividing operating profit by sales. The ROS is good proof of whether the revenue The Forbes Advisor editorial team is independent and objective. But EBITDA does not equal cash flow. beforeinterest,orEBIT. Your operating margin, for example, may provide a clearer picture of your overall health, according to Morningstar. Ray holds a journalism degree and teaches writing, career development and an FDIC course called "Money Smart.". ", "We needed an additional contact channel, and discovering Snov.io has allowed us to boost our conversion rate, both contact-to-reply and contact-to-call. If a companys ROS is on the rise, this signals growth at a steady efficient rate. Using the formula above, the return on cost is 8.33% ($7,000,000 + $3,000,000 / $1,200,000). Return on cost is similar to the cap rate but is a forward-looking metric because it accounts for the costs needed to stabilize a rental property and the resulting NOI once stabilized. This compensation comes from two main sources. Therefore, a higher return on assets value indicates that a business is more profitable and efficient. If we subtract COGS from sales, we are left with $50 million in gross profit (and a 50% gross profit margin). You can learn more about the standards we follow in producing accurate, unbiased content in our. 1. The difference between the two is that return on sales uses earnings/income before interest and taxes (EBIT) as the numerator (or top part of the equation). Say, for example, you pay $8,000 for goods and sell them for $10,000. Your profit is $2,000 (this is your earnings/income after interest and taxes). Lets take a look at how its used by both individual investors and businesses. In addition to gross margin and return on sales, other factors play into your company's successful financial picture. Return on cost is In the Create return order form, select a customer account, and then click OK. Operating income includes depreciation, while operating cash flow adds such non-cash measures back. While return on investment (ROI) measures the total return of an overall investment, return on ad spend (ROAS) only calculates your return in regard to a specific ad campaign. Return on sales, or ROS, also is shown in If you don't receive the email, be sure to check your spam folder before requesting the files again. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. ROI = (Present Value Cost of Investment / Cost of Investment) x 100 Lets say you invested $5,000 in the company XYZ last year, for example, and sold your Therefore, Investor A actually holds the better investment. ROI measures the return of an investment relative to the cost of the investment. The operating income metric is capital structure independent (i.e. Get Certified for Financial Modeling (FMVA). When it comes to trade shows (specifically trade show KPIs), two return metrics are equally important return on investment and return on objective. To check if the annualized return is correct, assume the initial cost of an investment is $20. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. A sales return is when a customer or client sends a product back to the seller. Say, you invested $1,000 into your online stores social media promotion. Spotforward parity [ edit] No wonder why investors, business owners, and creditors are obsessed with ROS! According to the website Principles of Accounting, the percentages reveal trends in your company sales and are not always strictly associated with actual dollar amounts. In fact, returns accounted for an average of 16.6% of total U.S. retail sales, which soared We're sending the requested files to your email now. The difference between ROS and operating margin lies in the numerators (top part of the equation)the ROS uses earnings before interest and taxes (EBIT), while the operating margin uses operating income. Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. By the end of the holiday season, youve gained $5,000 from sales boosted through the ad promotion youve invested in. Something went wrong. Return on Sales (ROS) Return on sales (ROS) is a metric that analyzes a companys operational efficiency. Suppose an investor is thinking about paying an asking price of $10 million for a 100% occupied, fully stabilized apartment building that generates $1 million in NOI today, implying a 10% cap rate ($10,000,000 / $1,000,000). ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. The average fee of a 2-year MBA program is $50,000 to $60,000 and that of an MS degree is $45,000. A higher ROS augurs well for the business. To calculate return on investment, divide the amount you earned from an investmentoften called the net profit, or the cost of the investment minus its present valueby the cost of the investment and multiply that by 100. 2. Apple. Annualized ROI can help avoid this limitation.

To calculate the operating margin, divide operating income (earnings) by sales (revenues). Expressed as a ratio, ROS can tell two important things about your overall revenue: To put it short: ROS shows how much profit is generated per dollar of revenue. It shows a relationship between how your managers use labor and cost of goods to produce saleable inventory. tax due is not equal to the tax withheld) resulting to collectible or refundable return Please try again later. The formula for calculating the return on sales ratio consists of dividing operating profit by sales. The ROS is good proof of whether the revenue The Forbes Advisor editorial team is independent and objective. But EBITDA does not equal cash flow. beforeinterest,orEBIT. Your operating margin, for example, may provide a clearer picture of your overall health, according to Morningstar. Ray holds a journalism degree and teaches writing, career development and an FDIC course called "Money Smart.". ", "We needed an additional contact channel, and discovering Snov.io has allowed us to boost our conversion rate, both contact-to-reply and contact-to-call. If a companys ROS is on the rise, this signals growth at a steady efficient rate. Using the formula above, the return on cost is 8.33% ($7,000,000 + $3,000,000 / $1,200,000). Return on cost is similar to the cap rate but is a forward-looking metric because it accounts for the costs needed to stabilize a rental property and the resulting NOI once stabilized. This compensation comes from two main sources. Therefore, a higher return on assets value indicates that a business is more profitable and efficient. If we subtract COGS from sales, we are left with $50 million in gross profit (and a 50% gross profit margin). You can learn more about the standards we follow in producing accurate, unbiased content in our. 1. The difference between the two is that return on sales uses earnings/income before interest and taxes (EBIT) as the numerator (or top part of the equation). Say, for example, you pay $8,000 for goods and sell them for $10,000. Your profit is $2,000 (this is your earnings/income after interest and taxes). Lets take a look at how its used by both individual investors and businesses. In addition to gross margin and return on sales, other factors play into your company's successful financial picture. Return on cost is In the Create return order form, select a customer account, and then click OK. Operating income includes depreciation, while operating cash flow adds such non-cash measures back. While return on investment (ROI) measures the total return of an overall investment, return on ad spend (ROAS) only calculates your return in regard to a specific ad campaign. Return on sales, or ROS, also is shown in If you don't receive the email, be sure to check your spam folder before requesting the files again. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. ROI = (Present Value Cost of Investment / Cost of Investment) x 100 Lets say you invested $5,000 in the company XYZ last year, for example, and sold your Therefore, Investor A actually holds the better investment. ROI measures the return of an investment relative to the cost of the investment. The operating income metric is capital structure independent (i.e. Get Certified for Financial Modeling (FMVA). When it comes to trade shows (specifically trade show KPIs), two return metrics are equally important return on investment and return on objective. To check if the annualized return is correct, assume the initial cost of an investment is $20. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. A sales return is when a customer or client sends a product back to the seller. Say, you invested $1,000 into your online stores social media promotion. Spotforward parity [ edit] No wonder why investors, business owners, and creditors are obsessed with ROS! According to the website Principles of Accounting, the percentages reveal trends in your company sales and are not always strictly associated with actual dollar amounts. In fact, returns accounted for an average of 16.6% of total U.S. retail sales, which soared We're sending the requested files to your email now. The difference between ROS and operating margin lies in the numerators (top part of the equation)the ROS uses earnings before interest and taxes (EBIT), while the operating margin uses operating income. Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. By the end of the holiday season, youve gained $5,000 from sales boosted through the ad promotion youve invested in. Something went wrong. Return on Sales (ROS) Return on sales (ROS) is a metric that analyzes a companys operational efficiency. Suppose an investor is thinking about paying an asking price of $10 million for a 100% occupied, fully stabilized apartment building that generates $1 million in NOI today, implying a 10% cap rate ($10,000,000 / $1,000,000). ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. The average fee of a 2-year MBA program is $50,000 to $60,000 and that of an MS degree is $45,000. A higher ROS augurs well for the business. To calculate return on investment, divide the amount you earned from an investmentoften called the net profit, or the cost of the investment minus its present valueby the cost of the investment and multiply that by 100. 2. Apple. Annualized ROI can help avoid this limitation.  $857.00. For example, if we are evaluating a property where the NOI is $100,000, and we know that the cap rates for similar properties in the same market are around 7%, we can quickly estimate a potential market value of the property of $1.42 million. is one of the countrys leading private equity commercial real estate investment firms. Return on sales (ROS) illustrates how much of your sales revenue is actual profit compared to your operating costs. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Locate operating profit on the income statement. The denominator in the cap rate equation, purchase price, can be influenced by a variety of factors, including location, tenant base, rental rates, and in-place leases. While the cost of returns impacts companies in many ways from lost sales, to increased labor costs, and even additional markdowns there is a way to recoup some of the loss. This article will explain how growth marketing stacks can improve your bottom line, in multiple ways, and simplify your marketing efforts while bringing a measurable return at a fraction of the cost you would spend on a 10-man team. This means investors should tread carefully. The comparison makes it easier to assess the performance of a small company than a Fortune 500 company. Assuming no interest cost, the return on the leveraged position would be: R = (1200-1000)/500 = 40% In this case, the ROI for Investment A is ($500-$100)/($100) = 400%, and the ROI for Investment B is ($400-$100)/($100) = 300%. WebDefinition Return On Sales (ROS) The Return on Sales (ROS) is a percentage measure, used to indicate how efficiently a business transforms sales into profits, e.g. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. The operating margin is operating income divided by sales. First, What is a Growth Marketing Stack? ROS Why Do Shareholders Need Financial Statements? Multiply the result by 100 to get a percentage. $24,202.33. An obvious way out is to strive for higher revenue while keeping the same expenses. $0.76. Buying/Selling, News. Some retailers are coming up with alternative solutions to try and curb the influx of returns such as open-box pricing, which are marked down items that have been sold, opened by the consumer, and then returned, but are in sellable condition. For example, companies in higher-margin industries, such as technology companies, will have higher ROS ratios compared to the likes of grocery chains. In this article, well break down the notion of ROS, its importance and inner workings, and explain how to calculate ROS to enhance your business with reliable financial data. Opinions expressed by Forbes Contributors are their own. Sales Snap a 12-month Long Decline as Buyers Return. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. Webthe theory of relativity musical character breakdown. 2. The ROI formula is pretty plain as it requires simply dividing the net return on the investment. To find out your ROS, subtract your expenses from your revenue. If the company's management team wants to increase efficiency, it can focus on increasing sales while incrementally increasing expenses, or it can focus on decreasing expenses while maintaining or increasing revenue. Return on sales is an important metric for any business showing how effectively the company uses its sales resources to generate revenue. where: ROS or operating margins that fluctuate a lot could suggest increased business risk. In other words, its the number of sales that a company is capable of converting into profits. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. After 3 years, $20 x 1.062659 x 1.062659 x 1.062659 = $24. It costs, on average, $18.68 and only $1.72 per click. The ratio, which is earnings Return on sales (ROS) and the operating margin are very similar profitability ratios, often used interchangeably. Leslie McVeety. Well now move to a modeling exercise, which you can access by filling out the form below. 2022 saw a gradual return of Japanese operating leases (JOLs) and Japanese operating leases with call options (JOLCOs) in the aviation sector. To calculate annualized ROI, you need to employ a little bit of algebra. Such tools can also drive initial sales as well as reducing returns. Cap rate and return on cost each have their own strengths and weaknesses for measuring real estate returns, but both metrics are useful when evaluating a propertys risk/return profile. WebAdvantages of Return on Sales. Replacing your front door and your garage door are relatively cheap projects delivering 85-100 percent WebEach year this cost vs. value analysis turns up similar trends on which projects deliver the most return on investment (ROI). Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Return on assets indicates the amount of money earned per dollar of assets. If spending $50,000 on advertising generated $750,000 in sales, the business owner would be getting a 1,400% ROI on the ad expenditure. This is why return-on-investment (ROI) is such an important metric for any business activity. ", "The open rate for the emails sent to leads collected and verified with Snov.io tools went from 25% to 73% in just one month, which resulted in 95 business meetings with potential customers. ROE is another indicator of your companys performance inferred from dividing your net annual income by shareholders equity. If only this information is given, you may assume that Investor B holds the better investment. Below are some of the advantages associated. NetSales earnings before interest and taxes (EBIT) represents the residual profits of a company once its cost of goods (COGS) and operating expenses (SG&A) have been subtracted. ROS can tell how a company can use its resources to convert sales into profits. Therefore, the return on sales answers the question: On the income statement, the Operating Income line item i.e. While the cap rate calculation itself may be simple, the logic behind it is anything but. Where Gain from Investment refers to the amount of profit generated from the sale of the investment, or the increase in value of the investment regardless of whether it is sold or not. This eliminates the return shipping fees and cuts losses in some cases, even though a full refund is given to customers. The return on sales uses operating income (EBIT) as the numerator to measure a companys profitability. Annualized ROI = {[1 + (Net Profit / Cost of Investment)] (1/n) 1} x 100. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. travis mcmichael married What Are The Challenges Of ROI? Both forms of measurement record the profits your company ultimately enjoys. Some measures of operating income are non-GAAP, such as certain non-recurring revenue and expenses items. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Here are two ways to represent this formula: ROI = (Net Profit / Cost of Investment) x 100, ROI = (Present Value Cost of Investment / Cost of Investment) x 100. So Alice would want at least $104,000 one year from now for the contract to be worthwhile for her the opportunity cost will be covered. ROI can be used for any type of investment. These products are essentially used to deploy Japanese equity, bringing back more diverse, cost-effective funding options to the sector while giving airlines the ability to fund 100% of their asset A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. However, let us continue the example by assuming Investor A incurred costs of $50 and Investor B incurred costs of $40,000 to attain the respective $200 and $50,000 profits. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Within the finance and banking industry, no one size fits all. EBIT allows for adjustments and allowances that GAAP does not allow for with operating income. Below are two examples of how return on investment can be commonly miscalculated. Enter your name and email in the form below and download the free template now! a. Copyright 2023 by Snov.io. By purchasing the asset with more risk and executing a successful turnaround plan, the investor has turned the same $10 million investment into a larger profit. One drawback to using the return on sales ratio, however, is the inclusion of non-cash expenses, namely depreciation and amortization. Its a profitability ratio. Return on Invested Capital The return on capital or invested capital in a business attempts to measure the return earned on capital invested in an investment. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. If one investment had an ROI of 20% over five years and another had an ROI of 15% over two years, the basic ROI calculation cannot help you determine which investment was best. Return on sales should only be used to compare companies that operate in the same industry, and ideally among those that have similar business models and annual sales figures. $24,202.33. 6,855. Notable non-recurring expenses include expenses that will not happen again, such as those incurred during mergers or acquisitions, or those incurred from the purchase of real estate or equipment. ROS Formula. The formula for ROS used in our return on sales calculator is simple: Return on Sales = Operating Profit / Net Sales x 100. Operating profit is also known as operating income in the U.K.. Both input values are in the relevant currency while the result is a ratio which is then converted to a percentage by a simple multiplication by 100. Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales and operating profit margin are often used to describe a similar financial ratio. Return on sales, or ROS, also is shown in percentage terms. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. The Most Crucial Financial Ratios for Penny Stocks. While return on sales and gross margin percentages are important tools to monitor your company's success, you must consider all the variables that go into the final numbers. Applying the same 10% cap rate to the $1.2 million in future NOI implies a value of $12 million. Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. Returnonsales They are reliable tools you can use to measure your growth compared to other companies in your industry. AMC gift cards that start with 6006 Therefore, ROS is used as an indicator of both efficiency and profitability. To arrive at an average annual return, follow the steps below. These metrics don't take into account the way businesses get their financing. When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned. MBA is a relatively expensive degree so it makes you wonder whether the ROI is worth it. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Start now! The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is also useful to compare one company's ROS percentage with that of a competing company, regardless of scale. Return on sales and operating profit margin are often used to describe a similar financial ratio. To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.

$857.00. For example, if we are evaluating a property where the NOI is $100,000, and we know that the cap rates for similar properties in the same market are around 7%, we can quickly estimate a potential market value of the property of $1.42 million. is one of the countrys leading private equity commercial real estate investment firms. Return on sales (ROS) illustrates how much of your sales revenue is actual profit compared to your operating costs. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Locate operating profit on the income statement. The denominator in the cap rate equation, purchase price, can be influenced by a variety of factors, including location, tenant base, rental rates, and in-place leases. While the cost of returns impacts companies in many ways from lost sales, to increased labor costs, and even additional markdowns there is a way to recoup some of the loss. This article will explain how growth marketing stacks can improve your bottom line, in multiple ways, and simplify your marketing efforts while bringing a measurable return at a fraction of the cost you would spend on a 10-man team. This means investors should tread carefully. The comparison makes it easier to assess the performance of a small company than a Fortune 500 company. Assuming no interest cost, the return on the leveraged position would be: R = (1200-1000)/500 = 40% In this case, the ROI for Investment A is ($500-$100)/($100) = 400%, and the ROI for Investment B is ($400-$100)/($100) = 300%. WebDefinition Return On Sales (ROS) The Return on Sales (ROS) is a percentage measure, used to indicate how efficiently a business transforms sales into profits, e.g. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. The operating margin is operating income divided by sales. First, What is a Growth Marketing Stack? ROS Why Do Shareholders Need Financial Statements? Multiply the result by 100 to get a percentage. $24,202.33. An obvious way out is to strive for higher revenue while keeping the same expenses. $0.76. Buying/Selling, News. Some retailers are coming up with alternative solutions to try and curb the influx of returns such as open-box pricing, which are marked down items that have been sold, opened by the consumer, and then returned, but are in sellable condition. For example, companies in higher-margin industries, such as technology companies, will have higher ROS ratios compared to the likes of grocery chains. In this article, well break down the notion of ROS, its importance and inner workings, and explain how to calculate ROS to enhance your business with reliable financial data. Opinions expressed by Forbes Contributors are their own. Sales Snap a 12-month Long Decline as Buyers Return. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. Webthe theory of relativity musical character breakdown. 2. The ROI formula is pretty plain as it requires simply dividing the net return on the investment. To find out your ROS, subtract your expenses from your revenue. If the company's management team wants to increase efficiency, it can focus on increasing sales while incrementally increasing expenses, or it can focus on decreasing expenses while maintaining or increasing revenue. Return on sales is an important metric for any business showing how effectively the company uses its sales resources to generate revenue. where: ROS or operating margins that fluctuate a lot could suggest increased business risk. In other words, its the number of sales that a company is capable of converting into profits. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. After 3 years, $20 x 1.062659 x 1.062659 x 1.062659 = $24. It costs, on average, $18.68 and only $1.72 per click. The ratio, which is earnings Return on sales (ROS) and the operating margin are very similar profitability ratios, often used interchangeably. Leslie McVeety. Well now move to a modeling exercise, which you can access by filling out the form below. 2022 saw a gradual return of Japanese operating leases (JOLs) and Japanese operating leases with call options (JOLCOs) in the aviation sector. To calculate annualized ROI, you need to employ a little bit of algebra. Such tools can also drive initial sales as well as reducing returns. Cap rate and return on cost each have their own strengths and weaknesses for measuring real estate returns, but both metrics are useful when evaluating a propertys risk/return profile. WebAdvantages of Return on Sales. Replacing your front door and your garage door are relatively cheap projects delivering 85-100 percent WebEach year this cost vs. value analysis turns up similar trends on which projects deliver the most return on investment (ROI). Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Return on assets indicates the amount of money earned per dollar of assets. If spending $50,000 on advertising generated $750,000 in sales, the business owner would be getting a 1,400% ROI on the ad expenditure. This is why return-on-investment (ROI) is such an important metric for any business activity. ", "The open rate for the emails sent to leads collected and verified with Snov.io tools went from 25% to 73% in just one month, which resulted in 95 business meetings with potential customers. ROE is another indicator of your companys performance inferred from dividing your net annual income by shareholders equity. If only this information is given, you may assume that Investor B holds the better investment. Below are some of the advantages associated. NetSales earnings before interest and taxes (EBIT) represents the residual profits of a company once its cost of goods (COGS) and operating expenses (SG&A) have been subtracted. ROS can tell how a company can use its resources to convert sales into profits. Therefore, the return on sales answers the question: On the income statement, the Operating Income line item i.e. While the cap rate calculation itself may be simple, the logic behind it is anything but. Where Gain from Investment refers to the amount of profit generated from the sale of the investment, or the increase in value of the investment regardless of whether it is sold or not. This eliminates the return shipping fees and cuts losses in some cases, even though a full refund is given to customers. The return on sales uses operating income (EBIT) as the numerator to measure a companys profitability. Annualized ROI = {[1 + (Net Profit / Cost of Investment)] (1/n) 1} x 100. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. travis mcmichael married What Are The Challenges Of ROI? Both forms of measurement record the profits your company ultimately enjoys. Some measures of operating income are non-GAAP, such as certain non-recurring revenue and expenses items. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Here are two ways to represent this formula: ROI = (Net Profit / Cost of Investment) x 100, ROI = (Present Value Cost of Investment / Cost of Investment) x 100. So Alice would want at least $104,000 one year from now for the contract to be worthwhile for her the opportunity cost will be covered. ROI can be used for any type of investment. These products are essentially used to deploy Japanese equity, bringing back more diverse, cost-effective funding options to the sector while giving airlines the ability to fund 100% of their asset A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. However, let us continue the example by assuming Investor A incurred costs of $50 and Investor B incurred costs of $40,000 to attain the respective $200 and $50,000 profits. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Within the finance and banking industry, no one size fits all. EBIT allows for adjustments and allowances that GAAP does not allow for with operating income. Below are two examples of how return on investment can be commonly miscalculated. Enter your name and email in the form below and download the free template now! a. Copyright 2023 by Snov.io. By purchasing the asset with more risk and executing a successful turnaround plan, the investor has turned the same $10 million investment into a larger profit. One drawback to using the return on sales ratio, however, is the inclusion of non-cash expenses, namely depreciation and amortization. Its a profitability ratio. Return on Invested Capital The return on capital or invested capital in a business attempts to measure the return earned on capital invested in an investment. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. If one investment had an ROI of 20% over five years and another had an ROI of 15% over two years, the basic ROI calculation cannot help you determine which investment was best. Return on sales should only be used to compare companies that operate in the same industry, and ideally among those that have similar business models and annual sales figures. $24,202.33. 6,855. Notable non-recurring expenses include expenses that will not happen again, such as those incurred during mergers or acquisitions, or those incurred from the purchase of real estate or equipment. ROS Formula. The formula for ROS used in our return on sales calculator is simple: Return on Sales = Operating Profit / Net Sales x 100. Operating profit is also known as operating income in the U.K.. Both input values are in the relevant currency while the result is a ratio which is then converted to a percentage by a simple multiplication by 100. Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales and operating profit margin are often used to describe a similar financial ratio. Return on sales, or ROS, also is shown in percentage terms. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. The Most Crucial Financial Ratios for Penny Stocks. While return on sales and gross margin percentages are important tools to monitor your company's success, you must consider all the variables that go into the final numbers. Applying the same 10% cap rate to the $1.2 million in future NOI implies a value of $12 million. Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. Returnonsales They are reliable tools you can use to measure your growth compared to other companies in your industry. AMC gift cards that start with 6006 Therefore, ROS is used as an indicator of both efficiency and profitability. To arrive at an average annual return, follow the steps below. These metrics don't take into account the way businesses get their financing. When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned. MBA is a relatively expensive degree so it makes you wonder whether the ROI is worth it. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Start now! The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is also useful to compare one company's ROS percentage with that of a competing company, regardless of scale. Return on sales and operating profit margin are often used to describe a similar financial ratio. To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.

To calculate the operating margin, divide operating income (earnings) by sales (revenues). Expressed as a ratio, ROS can tell two important things about your overall revenue: To put it short: ROS shows how much profit is generated per dollar of revenue. It shows a relationship between how your managers use labor and cost of goods to produce saleable inventory. tax due is not equal to the tax withheld) resulting to collectible or refundable return Please try again later. The formula for calculating the return on sales ratio consists of dividing operating profit by sales. The ROS is good proof of whether the revenue The Forbes Advisor editorial team is independent and objective. But EBITDA does not equal cash flow. beforeinterest,orEBIT. Your operating margin, for example, may provide a clearer picture of your overall health, according to Morningstar. Ray holds a journalism degree and teaches writing, career development and an FDIC course called "Money Smart.". ", "We needed an additional contact channel, and discovering Snov.io has allowed us to boost our conversion rate, both contact-to-reply and contact-to-call. If a companys ROS is on the rise, this signals growth at a steady efficient rate. Using the formula above, the return on cost is 8.33% ($7,000,000 + $3,000,000 / $1,200,000). Return on cost is similar to the cap rate but is a forward-looking metric because it accounts for the costs needed to stabilize a rental property and the resulting NOI once stabilized. This compensation comes from two main sources. Therefore, a higher return on assets value indicates that a business is more profitable and efficient. If we subtract COGS from sales, we are left with $50 million in gross profit (and a 50% gross profit margin). You can learn more about the standards we follow in producing accurate, unbiased content in our. 1. The difference between the two is that return on sales uses earnings/income before interest and taxes (EBIT) as the numerator (or top part of the equation). Say, for example, you pay $8,000 for goods and sell them for $10,000. Your profit is $2,000 (this is your earnings/income after interest and taxes). Lets take a look at how its used by both individual investors and businesses. In addition to gross margin and return on sales, other factors play into your company's successful financial picture. Return on cost is In the Create return order form, select a customer account, and then click OK. Operating income includes depreciation, while operating cash flow adds such non-cash measures back. While return on investment (ROI) measures the total return of an overall investment, return on ad spend (ROAS) only calculates your return in regard to a specific ad campaign. Return on sales, or ROS, also is shown in If you don't receive the email, be sure to check your spam folder before requesting the files again. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. ROI = (Present Value Cost of Investment / Cost of Investment) x 100 Lets say you invested $5,000 in the company XYZ last year, for example, and sold your Therefore, Investor A actually holds the better investment. ROI measures the return of an investment relative to the cost of the investment. The operating income metric is capital structure independent (i.e. Get Certified for Financial Modeling (FMVA). When it comes to trade shows (specifically trade show KPIs), two return metrics are equally important return on investment and return on objective. To check if the annualized return is correct, assume the initial cost of an investment is $20. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. A sales return is when a customer or client sends a product back to the seller. Say, you invested $1,000 into your online stores social media promotion. Spotforward parity [ edit] No wonder why investors, business owners, and creditors are obsessed with ROS! According to the website Principles of Accounting, the percentages reveal trends in your company sales and are not always strictly associated with actual dollar amounts. In fact, returns accounted for an average of 16.6% of total U.S. retail sales, which soared We're sending the requested files to your email now. The difference between ROS and operating margin lies in the numerators (top part of the equation)the ROS uses earnings before interest and taxes (EBIT), while the operating margin uses operating income. Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. By the end of the holiday season, youve gained $5,000 from sales boosted through the ad promotion youve invested in. Something went wrong. Return on Sales (ROS) Return on sales (ROS) is a metric that analyzes a companys operational efficiency. Suppose an investor is thinking about paying an asking price of $10 million for a 100% occupied, fully stabilized apartment building that generates $1 million in NOI today, implying a 10% cap rate ($10,000,000 / $1,000,000). ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. The average fee of a 2-year MBA program is $50,000 to $60,000 and that of an MS degree is $45,000. A higher ROS augurs well for the business. To calculate return on investment, divide the amount you earned from an investmentoften called the net profit, or the cost of the investment minus its present valueby the cost of the investment and multiply that by 100. 2. Apple. Annualized ROI can help avoid this limitation.

To calculate the operating margin, divide operating income (earnings) by sales (revenues). Expressed as a ratio, ROS can tell two important things about your overall revenue: To put it short: ROS shows how much profit is generated per dollar of revenue. It shows a relationship between how your managers use labor and cost of goods to produce saleable inventory. tax due is not equal to the tax withheld) resulting to collectible or refundable return Please try again later. The formula for calculating the return on sales ratio consists of dividing operating profit by sales. The ROS is good proof of whether the revenue The Forbes Advisor editorial team is independent and objective. But EBITDA does not equal cash flow. beforeinterest,orEBIT. Your operating margin, for example, may provide a clearer picture of your overall health, according to Morningstar. Ray holds a journalism degree and teaches writing, career development and an FDIC course called "Money Smart.". ", "We needed an additional contact channel, and discovering Snov.io has allowed us to boost our conversion rate, both contact-to-reply and contact-to-call. If a companys ROS is on the rise, this signals growth at a steady efficient rate. Using the formula above, the return on cost is 8.33% ($7,000,000 + $3,000,000 / $1,200,000). Return on cost is similar to the cap rate but is a forward-looking metric because it accounts for the costs needed to stabilize a rental property and the resulting NOI once stabilized. This compensation comes from two main sources. Therefore, a higher return on assets value indicates that a business is more profitable and efficient. If we subtract COGS from sales, we are left with $50 million in gross profit (and a 50% gross profit margin). You can learn more about the standards we follow in producing accurate, unbiased content in our. 1. The difference between the two is that return on sales uses earnings/income before interest and taxes (EBIT) as the numerator (or top part of the equation). Say, for example, you pay $8,000 for goods and sell them for $10,000. Your profit is $2,000 (this is your earnings/income after interest and taxes). Lets take a look at how its used by both individual investors and businesses. In addition to gross margin and return on sales, other factors play into your company's successful financial picture. Return on cost is In the Create return order form, select a customer account, and then click OK. Operating income includes depreciation, while operating cash flow adds such non-cash measures back. While return on investment (ROI) measures the total return of an overall investment, return on ad spend (ROAS) only calculates your return in regard to a specific ad campaign. Return on sales, or ROS, also is shown in If you don't receive the email, be sure to check your spam folder before requesting the files again. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. ROI = (Present Value Cost of Investment / Cost of Investment) x 100 Lets say you invested $5,000 in the company XYZ last year, for example, and sold your Therefore, Investor A actually holds the better investment. ROI measures the return of an investment relative to the cost of the investment. The operating income metric is capital structure independent (i.e. Get Certified for Financial Modeling (FMVA). When it comes to trade shows (specifically trade show KPIs), two return metrics are equally important return on investment and return on objective. To check if the annualized return is correct, assume the initial cost of an investment is $20. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. A sales return is when a customer or client sends a product back to the seller. Say, you invested $1,000 into your online stores social media promotion. Spotforward parity [ edit] No wonder why investors, business owners, and creditors are obsessed with ROS! According to the website Principles of Accounting, the percentages reveal trends in your company sales and are not always strictly associated with actual dollar amounts. In fact, returns accounted for an average of 16.6% of total U.S. retail sales, which soared We're sending the requested files to your email now. The difference between ROS and operating margin lies in the numerators (top part of the equation)the ROS uses earnings before interest and taxes (EBIT), while the operating margin uses operating income. Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. By the end of the holiday season, youve gained $5,000 from sales boosted through the ad promotion youve invested in. Something went wrong. Return on Sales (ROS) Return on sales (ROS) is a metric that analyzes a companys operational efficiency. Suppose an investor is thinking about paying an asking price of $10 million for a 100% occupied, fully stabilized apartment building that generates $1 million in NOI today, implying a 10% cap rate ($10,000,000 / $1,000,000). ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. The average fee of a 2-year MBA program is $50,000 to $60,000 and that of an MS degree is $45,000. A higher ROS augurs well for the business. To calculate return on investment, divide the amount you earned from an investmentoften called the net profit, or the cost of the investment minus its present valueby the cost of the investment and multiply that by 100. 2. Apple. Annualized ROI can help avoid this limitation.  $857.00. For example, if we are evaluating a property where the NOI is $100,000, and we know that the cap rates for similar properties in the same market are around 7%, we can quickly estimate a potential market value of the property of $1.42 million. is one of the countrys leading private equity commercial real estate investment firms. Return on sales (ROS) illustrates how much of your sales revenue is actual profit compared to your operating costs. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Locate operating profit on the income statement. The denominator in the cap rate equation, purchase price, can be influenced by a variety of factors, including location, tenant base, rental rates, and in-place leases. While the cost of returns impacts companies in many ways from lost sales, to increased labor costs, and even additional markdowns there is a way to recoup some of the loss. This article will explain how growth marketing stacks can improve your bottom line, in multiple ways, and simplify your marketing efforts while bringing a measurable return at a fraction of the cost you would spend on a 10-man team. This means investors should tread carefully. The comparison makes it easier to assess the performance of a small company than a Fortune 500 company. Assuming no interest cost, the return on the leveraged position would be: R = (1200-1000)/500 = 40% In this case, the ROI for Investment A is ($500-$100)/($100) = 400%, and the ROI for Investment B is ($400-$100)/($100) = 300%. WebDefinition Return On Sales (ROS) The Return on Sales (ROS) is a percentage measure, used to indicate how efficiently a business transforms sales into profits, e.g. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. The operating margin is operating income divided by sales. First, What is a Growth Marketing Stack? ROS Why Do Shareholders Need Financial Statements? Multiply the result by 100 to get a percentage. $24,202.33. An obvious way out is to strive for higher revenue while keeping the same expenses. $0.76. Buying/Selling, News. Some retailers are coming up with alternative solutions to try and curb the influx of returns such as open-box pricing, which are marked down items that have been sold, opened by the consumer, and then returned, but are in sellable condition. For example, companies in higher-margin industries, such as technology companies, will have higher ROS ratios compared to the likes of grocery chains. In this article, well break down the notion of ROS, its importance and inner workings, and explain how to calculate ROS to enhance your business with reliable financial data. Opinions expressed by Forbes Contributors are their own. Sales Snap a 12-month Long Decline as Buyers Return. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. Webthe theory of relativity musical character breakdown. 2. The ROI formula is pretty plain as it requires simply dividing the net return on the investment. To find out your ROS, subtract your expenses from your revenue. If the company's management team wants to increase efficiency, it can focus on increasing sales while incrementally increasing expenses, or it can focus on decreasing expenses while maintaining or increasing revenue. Return on sales is an important metric for any business showing how effectively the company uses its sales resources to generate revenue. where: ROS or operating margins that fluctuate a lot could suggest increased business risk. In other words, its the number of sales that a company is capable of converting into profits. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. After 3 years, $20 x 1.062659 x 1.062659 x 1.062659 = $24. It costs, on average, $18.68 and only $1.72 per click. The ratio, which is earnings Return on sales (ROS) and the operating margin are very similar profitability ratios, often used interchangeably. Leslie McVeety. Well now move to a modeling exercise, which you can access by filling out the form below. 2022 saw a gradual return of Japanese operating leases (JOLs) and Japanese operating leases with call options (JOLCOs) in the aviation sector. To calculate annualized ROI, you need to employ a little bit of algebra. Such tools can also drive initial sales as well as reducing returns. Cap rate and return on cost each have their own strengths and weaknesses for measuring real estate returns, but both metrics are useful when evaluating a propertys risk/return profile. WebAdvantages of Return on Sales. Replacing your front door and your garage door are relatively cheap projects delivering 85-100 percent WebEach year this cost vs. value analysis turns up similar trends on which projects deliver the most return on investment (ROI). Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Return on assets indicates the amount of money earned per dollar of assets. If spending $50,000 on advertising generated $750,000 in sales, the business owner would be getting a 1,400% ROI on the ad expenditure. This is why return-on-investment (ROI) is such an important metric for any business activity. ", "The open rate for the emails sent to leads collected and verified with Snov.io tools went from 25% to 73% in just one month, which resulted in 95 business meetings with potential customers. ROE is another indicator of your companys performance inferred from dividing your net annual income by shareholders equity. If only this information is given, you may assume that Investor B holds the better investment. Below are some of the advantages associated. NetSales earnings before interest and taxes (EBIT) represents the residual profits of a company once its cost of goods (COGS) and operating expenses (SG&A) have been subtracted. ROS can tell how a company can use its resources to convert sales into profits. Therefore, the return on sales answers the question: On the income statement, the Operating Income line item i.e. While the cap rate calculation itself may be simple, the logic behind it is anything but. Where Gain from Investment refers to the amount of profit generated from the sale of the investment, or the increase in value of the investment regardless of whether it is sold or not. This eliminates the return shipping fees and cuts losses in some cases, even though a full refund is given to customers. The return on sales uses operating income (EBIT) as the numerator to measure a companys profitability. Annualized ROI = {[1 + (Net Profit / Cost of Investment)] (1/n) 1} x 100. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. travis mcmichael married What Are The Challenges Of ROI? Both forms of measurement record the profits your company ultimately enjoys. Some measures of operating income are non-GAAP, such as certain non-recurring revenue and expenses items. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Here are two ways to represent this formula: ROI = (Net Profit / Cost of Investment) x 100, ROI = (Present Value Cost of Investment / Cost of Investment) x 100. So Alice would want at least $104,000 one year from now for the contract to be worthwhile for her the opportunity cost will be covered. ROI can be used for any type of investment. These products are essentially used to deploy Japanese equity, bringing back more diverse, cost-effective funding options to the sector while giving airlines the ability to fund 100% of their asset A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. However, let us continue the example by assuming Investor A incurred costs of $50 and Investor B incurred costs of $40,000 to attain the respective $200 and $50,000 profits. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Within the finance and banking industry, no one size fits all. EBIT allows for adjustments and allowances that GAAP does not allow for with operating income. Below are two examples of how return on investment can be commonly miscalculated. Enter your name and email in the form below and download the free template now! a. Copyright 2023 by Snov.io. By purchasing the asset with more risk and executing a successful turnaround plan, the investor has turned the same $10 million investment into a larger profit. One drawback to using the return on sales ratio, however, is the inclusion of non-cash expenses, namely depreciation and amortization. Its a profitability ratio. Return on Invested Capital The return on capital or invested capital in a business attempts to measure the return earned on capital invested in an investment. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. If one investment had an ROI of 20% over five years and another had an ROI of 15% over two years, the basic ROI calculation cannot help you determine which investment was best. Return on sales should only be used to compare companies that operate in the same industry, and ideally among those that have similar business models and annual sales figures. $24,202.33. 6,855. Notable non-recurring expenses include expenses that will not happen again, such as those incurred during mergers or acquisitions, or those incurred from the purchase of real estate or equipment. ROS Formula. The formula for ROS used in our return on sales calculator is simple: Return on Sales = Operating Profit / Net Sales x 100. Operating profit is also known as operating income in the U.K.. Both input values are in the relevant currency while the result is a ratio which is then converted to a percentage by a simple multiplication by 100. Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales and operating profit margin are often used to describe a similar financial ratio. Return on sales, or ROS, also is shown in percentage terms. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. The Most Crucial Financial Ratios for Penny Stocks. While return on sales and gross margin percentages are important tools to monitor your company's success, you must consider all the variables that go into the final numbers. Applying the same 10% cap rate to the $1.2 million in future NOI implies a value of $12 million. Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. Returnonsales They are reliable tools you can use to measure your growth compared to other companies in your industry. AMC gift cards that start with 6006 Therefore, ROS is used as an indicator of both efficiency and profitability. To arrive at an average annual return, follow the steps below. These metrics don't take into account the way businesses get their financing. When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned. MBA is a relatively expensive degree so it makes you wonder whether the ROI is worth it. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Start now! The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is also useful to compare one company's ROS percentage with that of a competing company, regardless of scale. Return on sales and operating profit margin are often used to describe a similar financial ratio. To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.

$857.00. For example, if we are evaluating a property where the NOI is $100,000, and we know that the cap rates for similar properties in the same market are around 7%, we can quickly estimate a potential market value of the property of $1.42 million. is one of the countrys leading private equity commercial real estate investment firms. Return on sales (ROS) illustrates how much of your sales revenue is actual profit compared to your operating costs. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Locate operating profit on the income statement. The denominator in the cap rate equation, purchase price, can be influenced by a variety of factors, including location, tenant base, rental rates, and in-place leases. While the cost of returns impacts companies in many ways from lost sales, to increased labor costs, and even additional markdowns there is a way to recoup some of the loss. This article will explain how growth marketing stacks can improve your bottom line, in multiple ways, and simplify your marketing efforts while bringing a measurable return at a fraction of the cost you would spend on a 10-man team. This means investors should tread carefully. The comparison makes it easier to assess the performance of a small company than a Fortune 500 company. Assuming no interest cost, the return on the leveraged position would be: R = (1200-1000)/500 = 40% In this case, the ROI for Investment A is ($500-$100)/($100) = 400%, and the ROI for Investment B is ($400-$100)/($100) = 300%. WebDefinition Return On Sales (ROS) The Return on Sales (ROS) is a percentage measure, used to indicate how efficiently a business transforms sales into profits, e.g. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. The operating margin is operating income divided by sales. First, What is a Growth Marketing Stack? ROS Why Do Shareholders Need Financial Statements? Multiply the result by 100 to get a percentage. $24,202.33. An obvious way out is to strive for higher revenue while keeping the same expenses. $0.76. Buying/Selling, News. Some retailers are coming up with alternative solutions to try and curb the influx of returns such as open-box pricing, which are marked down items that have been sold, opened by the consumer, and then returned, but are in sellable condition. For example, companies in higher-margin industries, such as technology companies, will have higher ROS ratios compared to the likes of grocery chains. In this article, well break down the notion of ROS, its importance and inner workings, and explain how to calculate ROS to enhance your business with reliable financial data. Opinions expressed by Forbes Contributors are their own. Sales Snap a 12-month Long Decline as Buyers Return. The event is headlined by the return of former UFC light heavyweight champion Jon Jones. Webthe theory of relativity musical character breakdown. 2. The ROI formula is pretty plain as it requires simply dividing the net return on the investment. To find out your ROS, subtract your expenses from your revenue. If the company's management team wants to increase efficiency, it can focus on increasing sales while incrementally increasing expenses, or it can focus on decreasing expenses while maintaining or increasing revenue. Return on sales is an important metric for any business showing how effectively the company uses its sales resources to generate revenue. where: ROS or operating margins that fluctuate a lot could suggest increased business risk. In other words, its the number of sales that a company is capable of converting into profits. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. After 3 years, $20 x 1.062659 x 1.062659 x 1.062659 = $24. It costs, on average, $18.68 and only $1.72 per click. The ratio, which is earnings Return on sales (ROS) and the operating margin are very similar profitability ratios, often used interchangeably. Leslie McVeety. Well now move to a modeling exercise, which you can access by filling out the form below. 2022 saw a gradual return of Japanese operating leases (JOLs) and Japanese operating leases with call options (JOLCOs) in the aviation sector. To calculate annualized ROI, you need to employ a little bit of algebra. Such tools can also drive initial sales as well as reducing returns. Cap rate and return on cost each have their own strengths and weaknesses for measuring real estate returns, but both metrics are useful when evaluating a propertys risk/return profile. WebAdvantages of Return on Sales. Replacing your front door and your garage door are relatively cheap projects delivering 85-100 percent WebEach year this cost vs. value analysis turns up similar trends on which projects deliver the most return on investment (ROI). Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Return on assets indicates the amount of money earned per dollar of assets. If spending $50,000 on advertising generated $750,000 in sales, the business owner would be getting a 1,400% ROI on the ad expenditure. This is why return-on-investment (ROI) is such an important metric for any business activity. ", "The open rate for the emails sent to leads collected and verified with Snov.io tools went from 25% to 73% in just one month, which resulted in 95 business meetings with potential customers. ROE is another indicator of your companys performance inferred from dividing your net annual income by shareholders equity. If only this information is given, you may assume that Investor B holds the better investment. Below are some of the advantages associated. NetSales earnings before interest and taxes (EBIT) represents the residual profits of a company once its cost of goods (COGS) and operating expenses (SG&A) have been subtracted. ROS can tell how a company can use its resources to convert sales into profits. Therefore, the return on sales answers the question: On the income statement, the Operating Income line item i.e. While the cap rate calculation itself may be simple, the logic behind it is anything but. Where Gain from Investment refers to the amount of profit generated from the sale of the investment, or the increase in value of the investment regardless of whether it is sold or not. This eliminates the return shipping fees and cuts losses in some cases, even though a full refund is given to customers. The return on sales uses operating income (EBIT) as the numerator to measure a companys profitability. Annualized ROI = {[1 + (Net Profit / Cost of Investment)] (1/n) 1} x 100. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. travis mcmichael married What Are The Challenges Of ROI? Both forms of measurement record the profits your company ultimately enjoys. Some measures of operating income are non-GAAP, such as certain non-recurring revenue and expenses items. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Here are two ways to represent this formula: ROI = (Net Profit / Cost of Investment) x 100, ROI = (Present Value Cost of Investment / Cost of Investment) x 100. So Alice would want at least $104,000 one year from now for the contract to be worthwhile for her the opportunity cost will be covered. ROI can be used for any type of investment. These products are essentially used to deploy Japanese equity, bringing back more diverse, cost-effective funding options to the sector while giving airlines the ability to fund 100% of their asset A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. However, let us continue the example by assuming Investor A incurred costs of $50 and Investor B incurred costs of $40,000 to attain the respective $200 and $50,000 profits. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Within the finance and banking industry, no one size fits all. EBIT allows for adjustments and allowances that GAAP does not allow for with operating income. Below are two examples of how return on investment can be commonly miscalculated. Enter your name and email in the form below and download the free template now! a. Copyright 2023 by Snov.io. By purchasing the asset with more risk and executing a successful turnaround plan, the investor has turned the same $10 million investment into a larger profit. One drawback to using the return on sales ratio, however, is the inclusion of non-cash expenses, namely depreciation and amortization. Its a profitability ratio. Return on Invested Capital The return on capital or invested capital in a business attempts to measure the return earned on capital invested in an investment. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. If one investment had an ROI of 20% over five years and another had an ROI of 15% over two years, the basic ROI calculation cannot help you determine which investment was best. Return on sales should only be used to compare companies that operate in the same industry, and ideally among those that have similar business models and annual sales figures. $24,202.33. 6,855. Notable non-recurring expenses include expenses that will not happen again, such as those incurred during mergers or acquisitions, or those incurred from the purchase of real estate or equipment. ROS Formula. The formula for ROS used in our return on sales calculator is simple: Return on Sales = Operating Profit / Net Sales x 100. Operating profit is also known as operating income in the U.K.. Both input values are in the relevant currency while the result is a ratio which is then converted to a percentage by a simple multiplication by 100. Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales and operating profit margin are often used to describe a similar financial ratio. Return on sales, or ROS, also is shown in percentage terms. The market undervalues John Deere at $400.79 as of Thursday, March 30, 2023. The Most Crucial Financial Ratios for Penny Stocks. While return on sales and gross margin percentages are important tools to monitor your company's success, you must consider all the variables that go into the final numbers. Applying the same 10% cap rate to the $1.2 million in future NOI implies a value of $12 million. Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. Returnonsales They are reliable tools you can use to measure your growth compared to other companies in your industry. AMC gift cards that start with 6006 Therefore, ROS is used as an indicator of both efficiency and profitability. To arrive at an average annual return, follow the steps below. These metrics don't take into account the way businesses get their financing. When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned. MBA is a relatively expensive degree so it makes you wonder whether the ROI is worth it. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Start now! The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is also useful to compare one company's ROS percentage with that of a competing company, regardless of scale. Return on sales and operating profit margin are often used to describe a similar financial ratio. To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.