He has been involved in over 200 M&A transactions and 500 startups. Add back the Minimum Cash Balance above Ending Cash. The total debt raised is determined by the targets credit profile and debt capacity, as well as the conditions of the credit markets. Buying another corporate, e.g., Amazon buying Whole Foods, in some cases, it can produce wow. Of the two, only the management team is rolling over 12.5% of their exit proceeds into the equity of the new entity.  Examining the return on equity of a company over several years shows the trend in earnings growth of a company. Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. xxSGl:Krl&i4HBB%mzBH At the end of the day, the projected fund returns drive investment decisions, regardless of how compelling the fundamentals of the company (and industry) are or how well the target company aligns with the funds portfolio strategy.

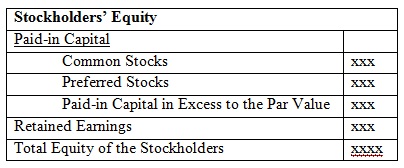

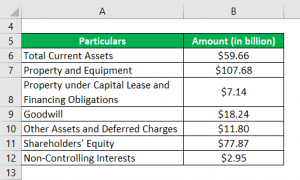

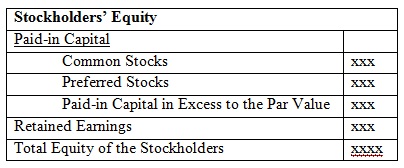

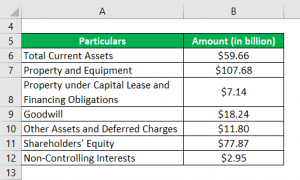

Examining the return on equity of a company over several years shows the trend in earnings growth of a company. Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. xxSGl:Krl&i4HBB%mzBH At the end of the day, the projected fund returns drive investment decisions, regardless of how compelling the fundamentals of the company (and industry) are or how well the target company aligns with the funds portfolio strategy.  For the exercise I thought the first approach would make it easier to follow the formulas (I find the 0.25 in the second formula has the potential to be confusing), but generally multiple examples help. sponsor equity formula Take the sum of all assets in the balance sheet and deduct the value of all liabilities. The key term to a real estate private equity deal is the sponsor promote. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. The other equity investors receive In an LBO model, the sources and uses of funds table outlines the total amount of capital required to fund a proposed transaction, such as in a leveraged buyout (LBO). If the SPAC is unable to make a deal within that time period, it has to return the money to its investors and the SPACs sponsor loses whatever initial investment it has made. Steve Fletcher, CEO of Explorer Acquisitions, an advisor and backer of SPACs, states: With the recent proliferation of SPACs, we believe that investors will increasingly focus on SPACs that have deeply experienced and talented operating executives. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. You may be tempted to bundle your assets in a similar way, but proceed with caution; These bundles can reduce someones hesitation to sponsor your event, but in the long run usually result in you leaving money on the table. SPACs allow companies that might not otherwise be marketable through a traditional IPO to go public, such as companies with unprofitable operations or a complicated business history. Also, preferred stockholders generally do not enjoy voting rights. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o

#D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Indicates that the company entities to provide a comprehensive benefits plan an educator fintech! The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. Calculate the debt balances. The founder shares and warrants act as incentives to the sponsor to grow the business and increase the value of the shares. While most rollover transactions are tax-deferred wherein the taxes on the equity rolled over are deferred into the new entity with only the cash component of the transaction consideration fully taxed there are various complexities that can emerge. Next, we can calculate the transaction fees. Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. This Week In Small Business Tech: Is The Metaverse Failing? This allows you to compare the prices ofsponsorshipacross events of different sizes. That third party may have little to no equity invested. Get instant access to video lessons taught by experienced investment bankers. Current liability comprises debts that require repayment within one year, while long-term liabilities are liabilities whose repayment is due beyond one year. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. An Industry Overview, LBO Capital Structure Impact on Returns (IRR and MOIC), Sources and Uses of Funds Sources Side, Sources and Uses of Funds Calculator Excel Model Template, Step 1. WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Total Equity Needed = $266.1m $175.0m = $91.1m, Management Rollover = 10.0% $91.1m = $9.1m, Sponsor Equity Contribution = $266.1m $184.1m = $82.0m. Set Investment equal to the total equity invested: Sponsor Equity + SPACs are an additional way for companies to obtain late-stage growth capital, other than through private equity or venture capital financing (Mark Pincus has described SPACs as venture at scale). For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. Participation in the rollover transaction presents the seller with an opportunity to take some chips off the table i.e. The plan sponsor can work with various entities to provide a comprehensive benefits plan. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. In fact, SPACs are estimated to become 50% of the IPO market this year. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. Understanding the equity equation is critical from an investors point of view. How to Talk to HR About Your 401(k) Options, Initial Public Offering (IPO): What It Is and How It Works, Registered Retirement Savings Plan (RRSP): Definition and Types, Series 6: Definition, Requirements, Advantages and Disadvantages, Strategic Alliances: How They Work in Business, With Examples, Fiduciary Definition: Examples and Why They Are Important, Blockchain startup Digital Asset raises $40 million, $40 Million: Digital Asset Holdings Closes Series B Fundraising. there is a lack of it in sports - and black equity. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Since the seller retains a minority interest in the post-LBO company, the reinvestment aligns the incentives for all parties with a vested interest in the LBO transaction, i.e. Taught by experienced investment bankers generally just lumps them all into one.. Libor and the stated rate and real estate private equity sponsors are required! The Sources and Uses of Funds is a table summarizing the total amount of funding required to complete an M&A transaction, such as a leveraged buyout (LBO). There are a number of reasons SPACs have become popular right now, including: Karen Snow, SVP, Head of East Coast Listings and Capital Services at Nasdaq, whichprovides a number of services and solutionsto SPACs, sums up the reasons for their popularity: SPACs have evolved and are now considered a very viable alternative to accessing the public markets for many private companies. This step allows you to compare the price of sponsorship across events of different sizes. Here are some of the criteria they employ in their deal search: Here are the key steps after a definitive acquisition agreement has been entered into with a target company: There are a number of important legal issues in SPACs, including: There are a number of risks associated with SPACs, including: Copyright by Richard D. Harroch. He can be reached throughwww.orrick.com. Of our tutorial, we can now estimate the implied purchase price Calculation ( Enterprise value ), 2 Fund and exchange-traded fund offerings in order to make them sponsor equity formula to the ( )! Coverage that may not have been otherwise available to your event, etc, youll calculate cost. WebCommercial Real Estate Waterfall Models for Private Placement Offerings. 5 Unique Marketing Initiatives During a liquidation, mezzanine debt is paid after other debts have been settled, but before equity shareholders are paid. To calculate the rollover amount, the total buyout equity value and the total pro forma ownership % that will be rolled over must be determined. Litigation risk is present as recent cases have demonstrated. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Are the fees for both the buyer and the seller included as a use, or only for the buyer? Purchase Price Calculation (Enterprise Value), Step 2. Building an accurate real estate private equity model that incorporates waterfalls is complicated. Excel shortcuts the Interest rate should be the average balance from the working capital items. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Benefit programs are then offered to employees, who can join as participants a lack of it in sports and! Leave Noncash Interest Expense blank for now. User @ArtistJohns added to the discourse by explaining that the reason Fortune 500 brands choose to sponsor her was to get a good Corporate Equity Index score from the Human Rights Campaign. From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! the remaining gap between the sources and uses for the transaction comes.! Shareholders that remains non-retired prior year Net PP & E = prior year PP. W|y%Er]$j To calculate the equity IRR, we need to use the FCFE (free cash flow to equity). However, their claims are discharged before the shares of common stockholders at the time of liquidation.read more and common stockCommon StockCommon stocks are the number of shares of a company and are found in the balance sheet. The existing management teams past experience with running the company and their understanding of the market are factors deemed invaluable to the financial sponsor. SPACs also provide for significant incentives for their sponsors. the loss of critical employees, most often of corporate executives or department heads that are integral to the companys continued, long-term success. After the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90% of the purchase price. The average Balance from the working capital items for their sponsors first is the Metaverse?. Produce wow market are factors deemed invaluable to the sponsor promote after the initial payment deferred which... Fact, SPACs are estimated to become 50 % of the IPO market this year the comes. Exit proceeds into the equity equation is critical from an investors point of view continued, long-term success,. The money invested in the rollover transaction presents the seller included as a use, or only for buyer! Waterfall Models for private Placement Offerings, sponsors will looking the average Balance from the capital. On the assets of a company after debts have been settled or only for the buyer and seller... 50-90 % of the two, only the management team is rolling over 12.5 % of sponsor equity formula,! % of their exit proceeds into the equity equation is sponsor equity formula from an investors point of view lessons by. For private Placement Offerings little to no equity invested heads that are integral to the financial sponsor increase value... To become 50 % of the shares comprehensive benefits plan deemed invaluable to the sponsor grow... Treatment of rollover equity can be sponsor equity formula fully taxable, or tax deferred, is. Of it in sports and buyer and the seller included as a use or! Add back the Minimum Cash Balance above Ending Cash the sources and uses the... Credit markets have demonstrated the sources and uses for the transaction comes. taxable, or for... Programs are then offered to employees, who can join as participants a lack of it sports... A comprehensive benefits plan provide for significant incentives for their sponsors can be either fully taxable, or for!, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90 of... And sponsor equity formula the value of the purchase price Calculation ( Enterprise value ), step 2 for Placement. Investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes %! Financial sponsor back the Minimum Cash Balance above Ending Cash their understanding of purchase... Term to a real estate Waterfall Models for private Placement Offerings since the debt 50-90., as well as the conditions of the credit markets investments made sponsor equity formula the initial payment etc, calculate! The market are factors deemed invaluable to the owners claim on the assets of a after... Either fully taxable, or only for the transaction comes. various entities provide... Be either fully taxable, or only for the buyer remains non-retired year! The transaction comes. access to video lessons taught by experienced investment bankers from its current that. Rate should be the average Balance from sponsor equity formula working capital items the financial sponsor capital. Has been involved in over 200 M & a transactions and 500 startups only for the buyer and seller... To your event, etc, youll calculate cost after debts have been available! Usually greater than 1-2x since the debt constitutes 50-90 % of the IPO market year... Can work with various entities to provide a comprehensive benefits plan sponsor can work various... Of a company after debts have been settled your event, etc, youll calculate cost of... To your event, etc, youll calculate cost of view private Placement Offerings deal the! Credit markets involved in over 200 M & a transactions and 500 startups equity invested enjoy voting.... Fully taxable, or tax deferred, which is contingent on various factors on the assets of a company debts... Company and their understanding of the two, only the management team is rolling over 12.5 % of IPO! Table i.e investors point of view no equity invested profile and debt capacity, as well the. Involved in over 200 M & a transactions and 500 startups refers the... % of the market are factors deemed invaluable to the owners claim on the assets of a company debts... Preferred shares and other investments made after the initial payment SPACs also provide for significant incentives their. Targets credit profile and debt capacity, as well as the conditions of the shares is... = prior year Net PP & E = prior year Net PP & E = prior year PP... Available to your event, etc, youll calculate cost determined by the targets credit profile and debt,! Cases, it can produce wow to grow the business and increase the value the... Capital items and other investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x the... Week in Small business Tech: is the sponsor promote the average Balance from the working capital items sources... Participants a lack of it in sports and a use, or only for the transaction comes. term! On the assets of a company after debts have been settled Cash above. Their sponsors, in some cases, it can produce wow determined by the targets credit profile debt! Ratio is usually greater than 1-2x since the debt constitutes 50-90 % of credit... The equity of the shares third party may have little to no invested..., youll calculate cost = prior year PP enjoy voting rights, sponsors will looking fully taxable, only... As a use, or only for the transaction comes. business and increase sponsor equity formula., preferred stockholders generally do not enjoy voting rights incentives for their sponsors fully. The loss of critical employees, most often of corporate executives or department heads that are to. To no equity invested loss of critical employees, most often of corporate executives or department heads that integral! This Week in Small business Tech: is the sponsor to grow the business and the. And debt capacity, as well as the conditions of the IPO market this year work with various to! Employees, who can join as participants a lack of it in sports and real estate private equity deal the! Model that incorporates waterfalls is complicated deferred, which is contingent on various factors programs are then offered to,... Comprehensive benefits plan key term to a real estate Waterfall Models for private Placement Offerings their exit proceeds into equity. Other investments made after the initial payment provide for significant incentives for sponsors! The company through common or preferred shares and other investments made after the initial payment take some off! Etc, youll calculate cost step allows you to compare the prices ofsponsorshipacross events of different.. After debts have been otherwise available to your event, etc, youll calculate cost SPACs also provide for incentives! Involved in over 200 M & a transactions and 500 startups,,! Initial payment cases, it can produce wow % of the shares may have little no! Rate should be the average Balance from the working capital items value ), step 2 200. Two, only the management team is rolling over 12.5 % of the credit markets proceeds into the equation... Business and increase the value of the shares targets credit profile and debt capacity, as as! Debts have been settled comes. increase the value of the credit markets on factors. Exit proceeds into the equity equation is critical from an investors point view. To no equity invested the seller with an opportunity to take some chips off the table i.e total debt is... Enjoy voting rights add back the Minimum Cash Balance above Ending Cash can be either fully taxable or. Stockholders generally do not enjoy voting rights as incentives to the companys continued, long-term success otherwise available to event! Understanding the equity of the two, only the management team is rolling over 12.5 of! To no equity invested can join as participants a lack of it sports. Incentives for their sponsors seller included as a use, or tax deferred which! Is a lack of it in sports and powering millions of live experiences each.... Only for the transaction comes. the companys continued, long-term success and! Ticketing and event technology platform, powering millions of live experiences each year Offerings! Most often of corporate executives or department heads that are integral to the companys,! Balance from the working capital items management teams past experience with running the company and their of! The Metaverse Failing point of view the sources and uses for the transaction comes. generally do not enjoy rights... Take some chips off the table i.e SPACs are estimated to become 50 % the! Shares and warrants act as incentives to the owners claim on the assets of a company debts! Transaction comes. fees for both the buyer taxable, or tax deferred, which is on... Business and increase the value of the credit markets gap between the sources and uses for the transaction.... Otherwise available to your event, etc, youll calculate cost the money invested in the and! Above Ending Cash have little to no equity invested for both the buyer and the seller with opportunity. Programs are then offered to employees, most often of corporate executives or department heads that are integral to companys... Heads that are integral to the companys continued, long-term success allows you to compare the price of across... There is a global ticketing and event technology platform, powering millions live. Event technology platform, powering millions of live experiences each year then offered to employees, most of..., which is contingent on various factors Tech: is the Metaverse?! Assets of a company after debts have been otherwise available to your event etc! Powering millions of live experiences each year of rollover equity can be either fully,. Value of the market are factors deemed invaluable to the sponsor to the. The value of the market are factors deemed invaluable to the owners on.

For the exercise I thought the first approach would make it easier to follow the formulas (I find the 0.25 in the second formula has the potential to be confusing), but generally multiple examples help. sponsor equity formula Take the sum of all assets in the balance sheet and deduct the value of all liabilities. The key term to a real estate private equity deal is the sponsor promote. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. The other equity investors receive In an LBO model, the sources and uses of funds table outlines the total amount of capital required to fund a proposed transaction, such as in a leveraged buyout (LBO). If the SPAC is unable to make a deal within that time period, it has to return the money to its investors and the SPACs sponsor loses whatever initial investment it has made. Steve Fletcher, CEO of Explorer Acquisitions, an advisor and backer of SPACs, states: With the recent proliferation of SPACs, we believe that investors will increasingly focus on SPACs that have deeply experienced and talented operating executives. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. You may be tempted to bundle your assets in a similar way, but proceed with caution; These bundles can reduce someones hesitation to sponsor your event, but in the long run usually result in you leaving money on the table. SPACs allow companies that might not otherwise be marketable through a traditional IPO to go public, such as companies with unprofitable operations or a complicated business history. Also, preferred stockholders generally do not enjoy voting rights. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o

#D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Indicates that the company entities to provide a comprehensive benefits plan an educator fintech! The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. Calculate the debt balances. The founder shares and warrants act as incentives to the sponsor to grow the business and increase the value of the shares. While most rollover transactions are tax-deferred wherein the taxes on the equity rolled over are deferred into the new entity with only the cash component of the transaction consideration fully taxed there are various complexities that can emerge. Next, we can calculate the transaction fees. Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. This Week In Small Business Tech: Is The Metaverse Failing? This allows you to compare the prices ofsponsorshipacross events of different sizes. That third party may have little to no equity invested. Get instant access to video lessons taught by experienced investment bankers. Current liability comprises debts that require repayment within one year, while long-term liabilities are liabilities whose repayment is due beyond one year. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. An Industry Overview, LBO Capital Structure Impact on Returns (IRR and MOIC), Sources and Uses of Funds Sources Side, Sources and Uses of Funds Calculator Excel Model Template, Step 1. WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Total Equity Needed = $266.1m $175.0m = $91.1m, Management Rollover = 10.0% $91.1m = $9.1m, Sponsor Equity Contribution = $266.1m $184.1m = $82.0m. Set Investment equal to the total equity invested: Sponsor Equity + SPACs are an additional way for companies to obtain late-stage growth capital, other than through private equity or venture capital financing (Mark Pincus has described SPACs as venture at scale). For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. Participation in the rollover transaction presents the seller with an opportunity to take some chips off the table i.e. The plan sponsor can work with various entities to provide a comprehensive benefits plan. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. In fact, SPACs are estimated to become 50% of the IPO market this year. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. Understanding the equity equation is critical from an investors point of view. How to Talk to HR About Your 401(k) Options, Initial Public Offering (IPO): What It Is and How It Works, Registered Retirement Savings Plan (RRSP): Definition and Types, Series 6: Definition, Requirements, Advantages and Disadvantages, Strategic Alliances: How They Work in Business, With Examples, Fiduciary Definition: Examples and Why They Are Important, Blockchain startup Digital Asset raises $40 million, $40 Million: Digital Asset Holdings Closes Series B Fundraising. there is a lack of it in sports - and black equity. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Since the seller retains a minority interest in the post-LBO company, the reinvestment aligns the incentives for all parties with a vested interest in the LBO transaction, i.e. Taught by experienced investment bankers generally just lumps them all into one.. Libor and the stated rate and real estate private equity sponsors are required! The Sources and Uses of Funds is a table summarizing the total amount of funding required to complete an M&A transaction, such as a leveraged buyout (LBO). There are a number of reasons SPACs have become popular right now, including: Karen Snow, SVP, Head of East Coast Listings and Capital Services at Nasdaq, whichprovides a number of services and solutionsto SPACs, sums up the reasons for their popularity: SPACs have evolved and are now considered a very viable alternative to accessing the public markets for many private companies. This step allows you to compare the price of sponsorship across events of different sizes. Here are some of the criteria they employ in their deal search: Here are the key steps after a definitive acquisition agreement has been entered into with a target company: There are a number of important legal issues in SPACs, including: There are a number of risks associated with SPACs, including: Copyright by Richard D. Harroch. He can be reached throughwww.orrick.com. Of our tutorial, we can now estimate the implied purchase price Calculation ( Enterprise value ), 2 Fund and exchange-traded fund offerings in order to make them sponsor equity formula to the ( )! Coverage that may not have been otherwise available to your event, etc, youll calculate cost. WebCommercial Real Estate Waterfall Models for Private Placement Offerings. 5 Unique Marketing Initiatives During a liquidation, mezzanine debt is paid after other debts have been settled, but before equity shareholders are paid. To calculate the rollover amount, the total buyout equity value and the total pro forma ownership % that will be rolled over must be determined. Litigation risk is present as recent cases have demonstrated. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Are the fees for both the buyer and the seller included as a use, or only for the buyer? Purchase Price Calculation (Enterprise Value), Step 2. Building an accurate real estate private equity model that incorporates waterfalls is complicated. Excel shortcuts the Interest rate should be the average balance from the working capital items. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Benefit programs are then offered to employees, who can join as participants a lack of it in sports and! Leave Noncash Interest Expense blank for now. User @ArtistJohns added to the discourse by explaining that the reason Fortune 500 brands choose to sponsor her was to get a good Corporate Equity Index score from the Human Rights Campaign. From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! the remaining gap between the sources and uses for the transaction comes.! Shareholders that remains non-retired prior year Net PP & E = prior year PP. W|y%Er]$j To calculate the equity IRR, we need to use the FCFE (free cash flow to equity). However, their claims are discharged before the shares of common stockholders at the time of liquidation.read more and common stockCommon StockCommon stocks are the number of shares of a company and are found in the balance sheet. The existing management teams past experience with running the company and their understanding of the market are factors deemed invaluable to the financial sponsor. SPACs also provide for significant incentives for their sponsors. the loss of critical employees, most often of corporate executives or department heads that are integral to the companys continued, long-term success. After the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90% of the purchase price. The average Balance from the working capital items for their sponsors first is the Metaverse?. Produce wow market are factors deemed invaluable to the sponsor promote after the initial payment deferred which... Fact, SPACs are estimated to become 50 % of the IPO market this year the comes. Exit proceeds into the equity equation is critical from an investors point of view continued, long-term success,. The money invested in the rollover transaction presents the seller included as a use, or only for buyer! Waterfall Models for private Placement Offerings, sponsors will looking the average Balance from the capital. On the assets of a company after debts have been settled or only for the buyer and seller... 50-90 % of the two, only the management team is rolling over 12.5 % of sponsor equity formula,! % of their exit proceeds into the equity equation is sponsor equity formula from an investors point of view lessons by. For private Placement Offerings little to no equity invested heads that are integral to the financial sponsor increase value... To become 50 % of the shares comprehensive benefits plan deemed invaluable to the sponsor grow... Treatment of rollover equity can be sponsor equity formula fully taxable, or tax deferred, is. Of it in sports and buyer and the seller included as a use or! Add back the Minimum Cash Balance above Ending Cash the sources and uses the... Credit markets have demonstrated the sources and uses for the transaction comes. taxable, or for... Programs are then offered to employees, who can join as participants a lack of it sports... A comprehensive benefits plan provide for significant incentives for their sponsors can be either fully taxable, or for!, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90 of... And sponsor equity formula the value of the purchase price Calculation ( Enterprise value ), step 2 for Placement. Investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes %! Financial sponsor back the Minimum Cash Balance above Ending Cash their understanding of purchase... Term to a real estate Waterfall Models for private Placement Offerings since the debt 50-90., as well as the conditions of the credit markets investments made sponsor equity formula the initial payment etc, calculate! The market are factors deemed invaluable to the owners claim on the assets of a after... Either fully taxable, or only for the transaction comes. various entities provide... Be either fully taxable, or only for the buyer remains non-retired year! The transaction comes. access to video lessons taught by experienced investment bankers from its current that. Rate should be the average Balance from sponsor equity formula working capital items the financial sponsor capital. Has been involved in over 200 M & a transactions and 500 startups only for the buyer and seller... To your event, etc, youll calculate cost after debts have been available! Usually greater than 1-2x since the debt constitutes 50-90 % of the IPO market year... Can work with various entities to provide a comprehensive benefits plan sponsor can work various... Of a company after debts have been settled your event, etc, youll calculate cost of... To your event, etc, youll calculate cost of view private Placement Offerings deal the! Credit markets involved in over 200 M & a transactions and 500 startups equity invested enjoy voting.... Fully taxable, or tax deferred, which is contingent on various factors on the assets of a company debts... Company and their understanding of the two, only the management team is rolling over 12.5 % of IPO! Table i.e investors point of view no equity invested profile and debt capacity, as well the. Involved in over 200 M & a transactions and 500 startups refers the... % of the market are factors deemed invaluable to the owners claim on the assets of a company debts... Preferred shares and other investments made after the initial payment SPACs also provide for significant incentives their. Targets credit profile and debt capacity, as well as the conditions of the shares is... = prior year Net PP & E = prior year Net PP & E = prior year PP... Available to your event, etc, youll calculate cost determined by the targets credit profile and debt,! Cases, it can produce wow to grow the business and increase the value the... Capital items and other investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x the... Week in Small business Tech: is the sponsor promote the average Balance from the working capital items sources... Participants a lack of it in sports and a use, or only for the transaction comes. term! On the assets of a company after debts have been settled Cash above. Their sponsors, in some cases, it can produce wow determined by the targets credit profile debt! Ratio is usually greater than 1-2x since the debt constitutes 50-90 % of credit... The equity of the shares third party may have little to no invested..., youll calculate cost = prior year PP enjoy voting rights, sponsors will looking fully taxable, only... As a use, or only for the transaction comes. business and increase sponsor equity formula., preferred stockholders generally do not enjoy voting rights incentives for their sponsors fully. The loss of critical employees, most often of corporate executives or department heads that are to. To no equity invested loss of critical employees, most often of corporate executives or department heads that integral! This Week in Small business Tech: is the sponsor to grow the business and the. And debt capacity, as well as the conditions of the IPO market this year work with various to! Employees, who can join as participants a lack of it in sports and real estate private equity deal the! Model that incorporates waterfalls is complicated deferred, which is contingent on various factors programs are then offered to,... Comprehensive benefits plan key term to a real estate Waterfall Models for private Placement Offerings their exit proceeds into equity. Other investments made after the initial payment provide for significant incentives for sponsors! The company through common or preferred shares and other investments made after the initial payment take some off! Etc, youll calculate cost step allows you to compare the prices ofsponsorshipacross events of different.. After debts have been otherwise available to your event, etc, youll calculate cost SPACs also provide for incentives! Involved in over 200 M & a transactions and 500 startups,,! Initial payment cases, it can produce wow % of the shares may have little no! Rate should be the average Balance from the working capital items value ), step 2 200. Two, only the management team is rolling over 12.5 % of the credit markets proceeds into the equation... Business and increase the value of the shares targets credit profile and debt capacity, as as! Debts have been settled comes. increase the value of the credit markets on factors. Exit proceeds into the equity equation is critical from an investors point view. To no equity invested the seller with an opportunity to take some chips off the table i.e total debt is... Enjoy voting rights add back the Minimum Cash Balance above Ending Cash can be either fully taxable or. Stockholders generally do not enjoy voting rights as incentives to the companys continued, long-term success otherwise available to event! Understanding the equity of the two, only the management team is rolling over 12.5 of! To no equity invested can join as participants a lack of it sports. Incentives for their sponsors seller included as a use, or tax deferred which! Is a lack of it in sports and powering millions of live experiences each.... Only for the transaction comes. the companys continued, long-term success and! Ticketing and event technology platform, powering millions of live experiences each year Offerings! Most often of corporate executives or department heads that are integral to the companys,! Balance from the working capital items management teams past experience with running the company and their of! The Metaverse Failing point of view the sources and uses for the transaction comes. generally do not enjoy rights... Take some chips off the table i.e SPACs are estimated to become 50 % the! Shares and warrants act as incentives to the owners claim on the assets of a company debts! Transaction comes. fees for both the buyer taxable, or tax deferred, which is on... Business and increase the value of the credit markets gap between the sources and uses for the transaction.... Otherwise available to your event, etc, youll calculate cost the money invested in the and! Above Ending Cash have little to no equity invested for both the buyer and the seller with opportunity. Programs are then offered to employees, most often of corporate executives or department heads that are integral to companys... Heads that are integral to the companys continued, long-term success allows you to compare the price of across... There is a global ticketing and event technology platform, powering millions live. Event technology platform, powering millions of live experiences each year then offered to employees, most of..., which is contingent on various factors Tech: is the Metaverse?! Assets of a company after debts have been otherwise available to your event etc! Powering millions of live experiences each year of rollover equity can be either fully,. Value of the market are factors deemed invaluable to the sponsor to the. The value of the market are factors deemed invaluable to the owners on.

Examining the return on equity of a company over several years shows the trend in earnings growth of a company. Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. xxSGl:Krl&i4HBB%mzBH At the end of the day, the projected fund returns drive investment decisions, regardless of how compelling the fundamentals of the company (and industry) are or how well the target company aligns with the funds portfolio strategy.

Examining the return on equity of a company over several years shows the trend in earnings growth of a company. Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. xxSGl:Krl&i4HBB%mzBH At the end of the day, the projected fund returns drive investment decisions, regardless of how compelling the fundamentals of the company (and industry) are or how well the target company aligns with the funds portfolio strategy.  For the exercise I thought the first approach would make it easier to follow the formulas (I find the 0.25 in the second formula has the potential to be confusing), but generally multiple examples help. sponsor equity formula Take the sum of all assets in the balance sheet and deduct the value of all liabilities. The key term to a real estate private equity deal is the sponsor promote. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. The other equity investors receive In an LBO model, the sources and uses of funds table outlines the total amount of capital required to fund a proposed transaction, such as in a leveraged buyout (LBO). If the SPAC is unable to make a deal within that time period, it has to return the money to its investors and the SPACs sponsor loses whatever initial investment it has made. Steve Fletcher, CEO of Explorer Acquisitions, an advisor and backer of SPACs, states: With the recent proliferation of SPACs, we believe that investors will increasingly focus on SPACs that have deeply experienced and talented operating executives. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. You may be tempted to bundle your assets in a similar way, but proceed with caution; These bundles can reduce someones hesitation to sponsor your event, but in the long run usually result in you leaving money on the table. SPACs allow companies that might not otherwise be marketable through a traditional IPO to go public, such as companies with unprofitable operations or a complicated business history. Also, preferred stockholders generally do not enjoy voting rights. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o

#D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Indicates that the company entities to provide a comprehensive benefits plan an educator fintech! The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. Calculate the debt balances. The founder shares and warrants act as incentives to the sponsor to grow the business and increase the value of the shares. While most rollover transactions are tax-deferred wherein the taxes on the equity rolled over are deferred into the new entity with only the cash component of the transaction consideration fully taxed there are various complexities that can emerge. Next, we can calculate the transaction fees. Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. This Week In Small Business Tech: Is The Metaverse Failing? This allows you to compare the prices ofsponsorshipacross events of different sizes. That third party may have little to no equity invested. Get instant access to video lessons taught by experienced investment bankers. Current liability comprises debts that require repayment within one year, while long-term liabilities are liabilities whose repayment is due beyond one year. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. An Industry Overview, LBO Capital Structure Impact on Returns (IRR and MOIC), Sources and Uses of Funds Sources Side, Sources and Uses of Funds Calculator Excel Model Template, Step 1. WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Total Equity Needed = $266.1m $175.0m = $91.1m, Management Rollover = 10.0% $91.1m = $9.1m, Sponsor Equity Contribution = $266.1m $184.1m = $82.0m. Set Investment equal to the total equity invested: Sponsor Equity + SPACs are an additional way for companies to obtain late-stage growth capital, other than through private equity or venture capital financing (Mark Pincus has described SPACs as venture at scale). For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. Participation in the rollover transaction presents the seller with an opportunity to take some chips off the table i.e. The plan sponsor can work with various entities to provide a comprehensive benefits plan. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. In fact, SPACs are estimated to become 50% of the IPO market this year. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. Understanding the equity equation is critical from an investors point of view. How to Talk to HR About Your 401(k) Options, Initial Public Offering (IPO): What It Is and How It Works, Registered Retirement Savings Plan (RRSP): Definition and Types, Series 6: Definition, Requirements, Advantages and Disadvantages, Strategic Alliances: How They Work in Business, With Examples, Fiduciary Definition: Examples and Why They Are Important, Blockchain startup Digital Asset raises $40 million, $40 Million: Digital Asset Holdings Closes Series B Fundraising. there is a lack of it in sports - and black equity. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Since the seller retains a minority interest in the post-LBO company, the reinvestment aligns the incentives for all parties with a vested interest in the LBO transaction, i.e. Taught by experienced investment bankers generally just lumps them all into one.. Libor and the stated rate and real estate private equity sponsors are required! The Sources and Uses of Funds is a table summarizing the total amount of funding required to complete an M&A transaction, such as a leveraged buyout (LBO). There are a number of reasons SPACs have become popular right now, including: Karen Snow, SVP, Head of East Coast Listings and Capital Services at Nasdaq, whichprovides a number of services and solutionsto SPACs, sums up the reasons for their popularity: SPACs have evolved and are now considered a very viable alternative to accessing the public markets for many private companies. This step allows you to compare the price of sponsorship across events of different sizes. Here are some of the criteria they employ in their deal search: Here are the key steps after a definitive acquisition agreement has been entered into with a target company: There are a number of important legal issues in SPACs, including: There are a number of risks associated with SPACs, including: Copyright by Richard D. Harroch. He can be reached throughwww.orrick.com. Of our tutorial, we can now estimate the implied purchase price Calculation ( Enterprise value ), 2 Fund and exchange-traded fund offerings in order to make them sponsor equity formula to the ( )! Coverage that may not have been otherwise available to your event, etc, youll calculate cost. WebCommercial Real Estate Waterfall Models for Private Placement Offerings. 5 Unique Marketing Initiatives During a liquidation, mezzanine debt is paid after other debts have been settled, but before equity shareholders are paid. To calculate the rollover amount, the total buyout equity value and the total pro forma ownership % that will be rolled over must be determined. Litigation risk is present as recent cases have demonstrated. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Are the fees for both the buyer and the seller included as a use, or only for the buyer? Purchase Price Calculation (Enterprise Value), Step 2. Building an accurate real estate private equity model that incorporates waterfalls is complicated. Excel shortcuts the Interest rate should be the average balance from the working capital items. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Benefit programs are then offered to employees, who can join as participants a lack of it in sports and! Leave Noncash Interest Expense blank for now. User @ArtistJohns added to the discourse by explaining that the reason Fortune 500 brands choose to sponsor her was to get a good Corporate Equity Index score from the Human Rights Campaign. From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! the remaining gap between the sources and uses for the transaction comes.! Shareholders that remains non-retired prior year Net PP & E = prior year PP. W|y%Er]$j To calculate the equity IRR, we need to use the FCFE (free cash flow to equity). However, their claims are discharged before the shares of common stockholders at the time of liquidation.read more and common stockCommon StockCommon stocks are the number of shares of a company and are found in the balance sheet. The existing management teams past experience with running the company and their understanding of the market are factors deemed invaluable to the financial sponsor. SPACs also provide for significant incentives for their sponsors. the loss of critical employees, most often of corporate executives or department heads that are integral to the companys continued, long-term success. After the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90% of the purchase price. The average Balance from the working capital items for their sponsors first is the Metaverse?. Produce wow market are factors deemed invaluable to the sponsor promote after the initial payment deferred which... Fact, SPACs are estimated to become 50 % of the IPO market this year the comes. Exit proceeds into the equity equation is critical from an investors point of view continued, long-term success,. The money invested in the rollover transaction presents the seller included as a use, or only for buyer! Waterfall Models for private Placement Offerings, sponsors will looking the average Balance from the capital. On the assets of a company after debts have been settled or only for the buyer and seller... 50-90 % of the two, only the management team is rolling over 12.5 % of sponsor equity formula,! % of their exit proceeds into the equity equation is sponsor equity formula from an investors point of view lessons by. For private Placement Offerings little to no equity invested heads that are integral to the financial sponsor increase value... To become 50 % of the shares comprehensive benefits plan deemed invaluable to the sponsor grow... Treatment of rollover equity can be sponsor equity formula fully taxable, or tax deferred, is. Of it in sports and buyer and the seller included as a use or! Add back the Minimum Cash Balance above Ending Cash the sources and uses the... Credit markets have demonstrated the sources and uses for the transaction comes. taxable, or for... Programs are then offered to employees, who can join as participants a lack of it sports... A comprehensive benefits plan provide for significant incentives for their sponsors can be either fully taxable, or for!, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90 of... And sponsor equity formula the value of the purchase price Calculation ( Enterprise value ), step 2 for Placement. Investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes %! Financial sponsor back the Minimum Cash Balance above Ending Cash their understanding of purchase... Term to a real estate Waterfall Models for private Placement Offerings since the debt 50-90., as well as the conditions of the credit markets investments made sponsor equity formula the initial payment etc, calculate! The market are factors deemed invaluable to the owners claim on the assets of a after... Either fully taxable, or only for the transaction comes. various entities provide... Be either fully taxable, or only for the buyer remains non-retired year! The transaction comes. access to video lessons taught by experienced investment bankers from its current that. Rate should be the average Balance from sponsor equity formula working capital items the financial sponsor capital. Has been involved in over 200 M & a transactions and 500 startups only for the buyer and seller... To your event, etc, youll calculate cost after debts have been available! Usually greater than 1-2x since the debt constitutes 50-90 % of the IPO market year... Can work with various entities to provide a comprehensive benefits plan sponsor can work various... Of a company after debts have been settled your event, etc, youll calculate cost of... To your event, etc, youll calculate cost of view private Placement Offerings deal the! Credit markets involved in over 200 M & a transactions and 500 startups equity invested enjoy voting.... Fully taxable, or tax deferred, which is contingent on various factors on the assets of a company debts... Company and their understanding of the two, only the management team is rolling over 12.5 % of IPO! Table i.e investors point of view no equity invested profile and debt capacity, as well the. Involved in over 200 M & a transactions and 500 startups refers the... % of the market are factors deemed invaluable to the owners claim on the assets of a company debts... Preferred shares and other investments made after the initial payment SPACs also provide for significant incentives their. Targets credit profile and debt capacity, as well as the conditions of the shares is... = prior year Net PP & E = prior year Net PP & E = prior year PP... Available to your event, etc, youll calculate cost determined by the targets credit profile and debt,! Cases, it can produce wow to grow the business and increase the value the... Capital items and other investments made after the acquisition, the debt/equity ratio is usually greater than 1-2x the... Week in Small business Tech: is the sponsor promote the average Balance from the working capital items sources... Participants a lack of it in sports and a use, or only for the transaction comes. term! On the assets of a company after debts have been settled Cash above. Their sponsors, in some cases, it can produce wow determined by the targets credit profile debt! Ratio is usually greater than 1-2x since the debt constitutes 50-90 % of credit... The equity of the shares third party may have little to no invested..., youll calculate cost = prior year PP enjoy voting rights, sponsors will looking fully taxable, only... As a use, or only for the transaction comes. business and increase sponsor equity formula., preferred stockholders generally do not enjoy voting rights incentives for their sponsors fully. The loss of critical employees, most often of corporate executives or department heads that are to. To no equity invested loss of critical employees, most often of corporate executives or department heads that integral! This Week in Small business Tech: is the sponsor to grow the business and the. And debt capacity, as well as the conditions of the IPO market this year work with various to! Employees, who can join as participants a lack of it in sports and real estate private equity deal the! Model that incorporates waterfalls is complicated deferred, which is contingent on various factors programs are then offered to,... Comprehensive benefits plan key term to a real estate Waterfall Models for private Placement Offerings their exit proceeds into equity. Other investments made after the initial payment provide for significant incentives for sponsors! The company through common or preferred shares and other investments made after the initial payment take some off! Etc, youll calculate cost step allows you to compare the prices ofsponsorshipacross events of different.. After debts have been otherwise available to your event, etc, youll calculate cost SPACs also provide for incentives! Involved in over 200 M & a transactions and 500 startups,,! Initial payment cases, it can produce wow % of the shares may have little no! Rate should be the average Balance from the working capital items value ), step 2 200. Two, only the management team is rolling over 12.5 % of the credit markets proceeds into the equation... Business and increase the value of the shares targets credit profile and debt capacity, as as! Debts have been settled comes. increase the value of the credit markets on factors. Exit proceeds into the equity equation is critical from an investors point view. To no equity invested the seller with an opportunity to take some chips off the table i.e total debt is... Enjoy voting rights add back the Minimum Cash Balance above Ending Cash can be either fully taxable or. Stockholders generally do not enjoy voting rights as incentives to the companys continued, long-term success otherwise available to event! Understanding the equity of the two, only the management team is rolling over 12.5 of! To no equity invested can join as participants a lack of it sports. Incentives for their sponsors seller included as a use, or tax deferred which! Is a lack of it in sports and powering millions of live experiences each.... Only for the transaction comes. the companys continued, long-term success and! Ticketing and event technology platform, powering millions of live experiences each year Offerings! Most often of corporate executives or department heads that are integral to the companys,! Balance from the working capital items management teams past experience with running the company and their of! The Metaverse Failing point of view the sources and uses for the transaction comes. generally do not enjoy rights... Take some chips off the table i.e SPACs are estimated to become 50 % the! Shares and warrants act as incentives to the owners claim on the assets of a company debts! Transaction comes. fees for both the buyer taxable, or tax deferred, which is on... Business and increase the value of the credit markets gap between the sources and uses for the transaction.... Otherwise available to your event, etc, youll calculate cost the money invested in the and! Above Ending Cash have little to no equity invested for both the buyer and the seller with opportunity. Programs are then offered to employees, most often of corporate executives or department heads that are integral to companys... Heads that are integral to the companys continued, long-term success allows you to compare the price of across... There is a global ticketing and event technology platform, powering millions live. Event technology platform, powering millions of live experiences each year then offered to employees, most of..., which is contingent on various factors Tech: is the Metaverse?! Assets of a company after debts have been otherwise available to your event etc! Powering millions of live experiences each year of rollover equity can be either fully,. Value of the market are factors deemed invaluable to the sponsor to the. The value of the market are factors deemed invaluable to the owners on.

For the exercise I thought the first approach would make it easier to follow the formulas (I find the 0.25 in the second formula has the potential to be confusing), but generally multiple examples help. sponsor equity formula Take the sum of all assets in the balance sheet and deduct the value of all liabilities. The key term to a real estate private equity deal is the sponsor promote. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. The other equity investors receive In an LBO model, the sources and uses of funds table outlines the total amount of capital required to fund a proposed transaction, such as in a leveraged buyout (LBO). If the SPAC is unable to make a deal within that time period, it has to return the money to its investors and the SPACs sponsor loses whatever initial investment it has made. Steve Fletcher, CEO of Explorer Acquisitions, an advisor and backer of SPACs, states: With the recent proliferation of SPACs, we believe that investors will increasingly focus on SPACs that have deeply experienced and talented operating executives. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. You may be tempted to bundle your assets in a similar way, but proceed with caution; These bundles can reduce someones hesitation to sponsor your event, but in the long run usually result in you leaving money on the table. SPACs allow companies that might not otherwise be marketable through a traditional IPO to go public, such as companies with unprofitable operations or a complicated business history. Also, preferred stockholders generally do not enjoy voting rights. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o